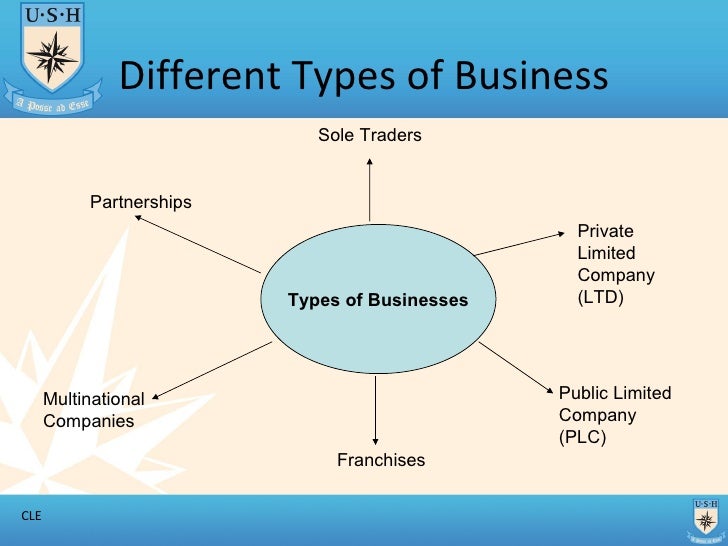

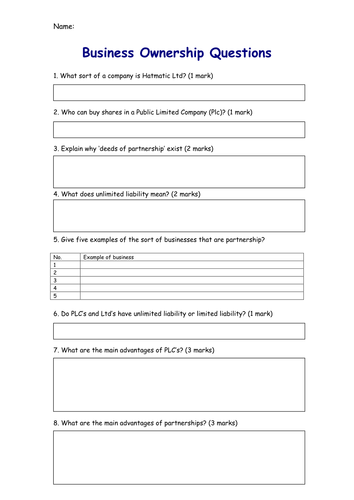

Public Limited Company PLC A public limited company (PLC) is the legal designation of a limited liability company which has offered shares to the general public and has limited liability A PLCA public limited company (legally abbreviated to PLC or plc) is a type of public company under United Kingdom company law, some Commonwealth jurisdictions, and the Republic of Ireland It is a limited liability company whose shares may be freely sold and traded to the public (although a PLC may also be privately held, often by another PLC), with a minimum share capital of £50,000 Definition of Public Limited Company A Public Limited Company or PLC is a jointstock company that is created and incorporated under The Indian Companies Act, 13 or any other act being in force previously It is listed on a recognized stock exchange to raise capital from the general public It is a company with limited liability and is permitted to issue registered

Convert Pvt To Plc Advantages For Public Limited Company

Plc public limited company

Plc public limited company-A Public Limited Company (PLC) is a type of Limited Company in the United Kingdom which is permitted to offer its shares to the public A PLC Company is the only type of UK Company which can raise money by selling shares to the general public, shares may or may not be traded on the stock exchange in the UK Our comprehensive packages for a PLC formation are shown below IfPublic Limited Company (Plc) Larger businesses may choose to become a public limited company (Plc) In a Plc, shares are sold to the public on the stock market

Public Limited Company Definition Features Advantages Disadvantages

Making them available for the general public As per the regulations of the corporate law in India, a PLC has to mandatorily present its financial statistics and position to the public in order to maintain Although not every PLC will pay out extensive dividends to shareholders, you'll still be paying out more of your profits when you have taken your company public You're responsible for their financial wellbeing from the investment in addition to your own, which means the decisions you can make for the company may be limited because you must keep the company in thePublic limited company definition A public limited company is a business that is managed by directors and owned by shareholders A public limited company can offer shares to the public There are also other obligations that a PLC must meet due to being public, including further admin regarding tax, and making their financial reports public so

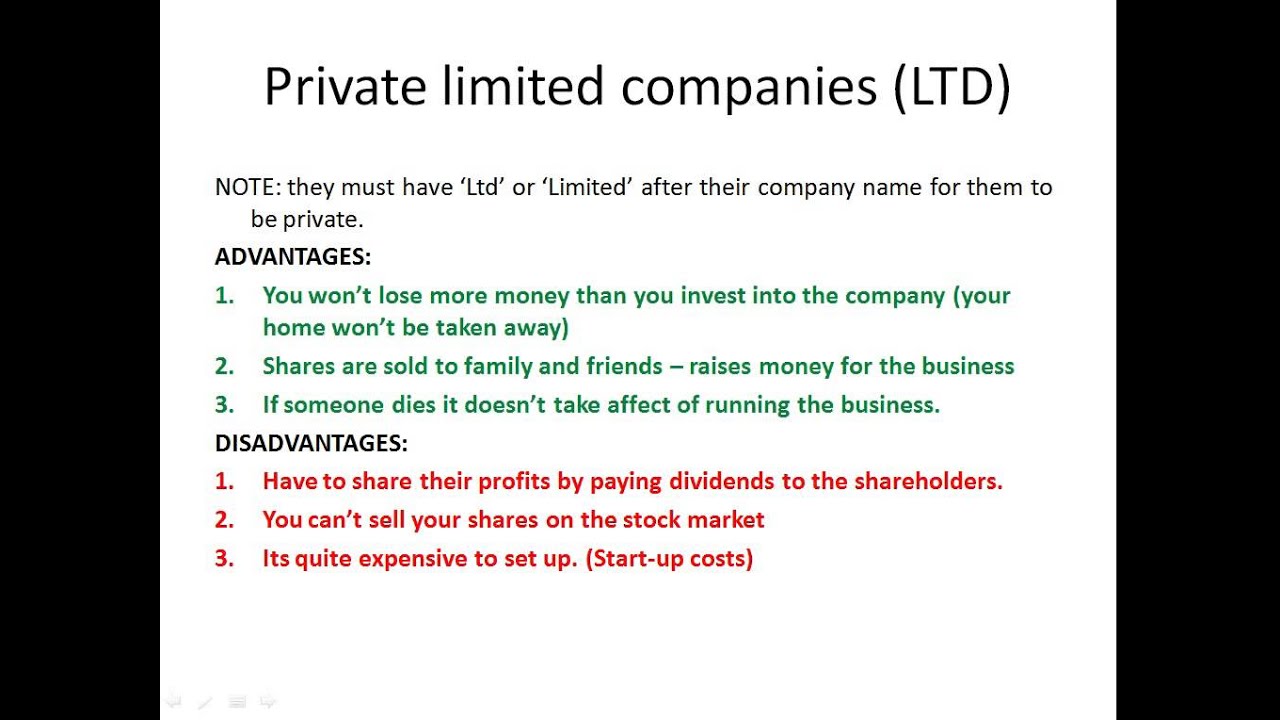

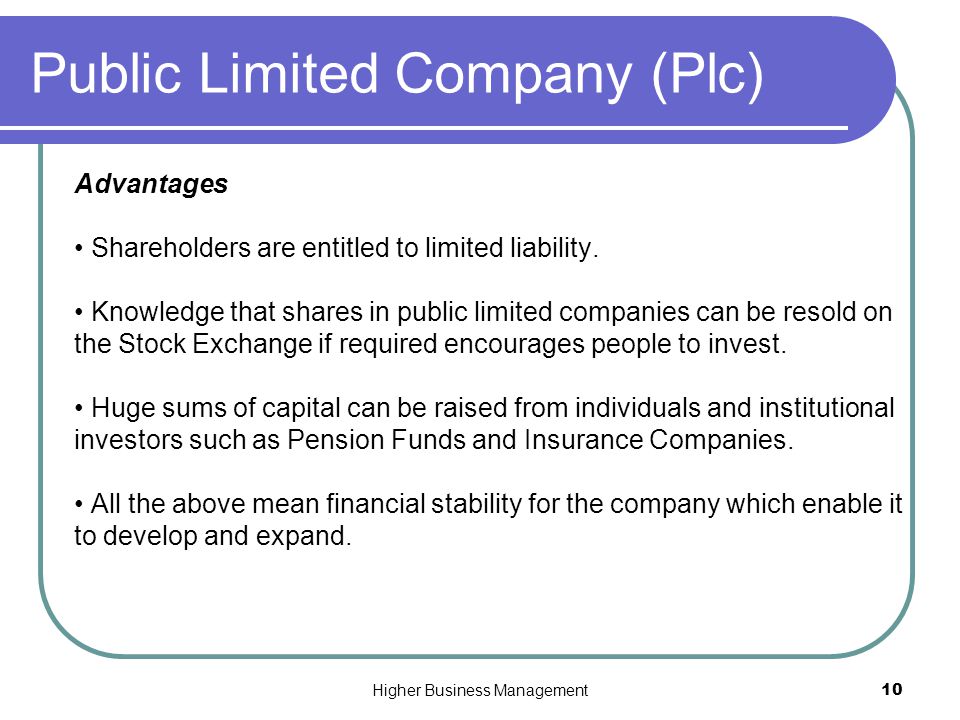

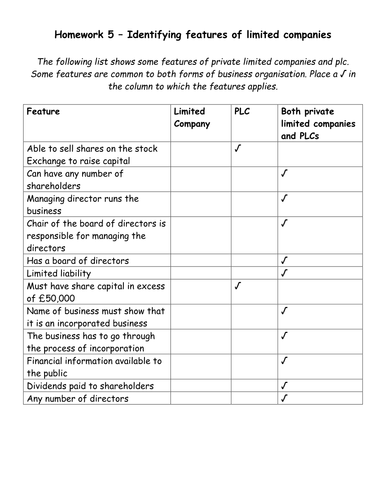

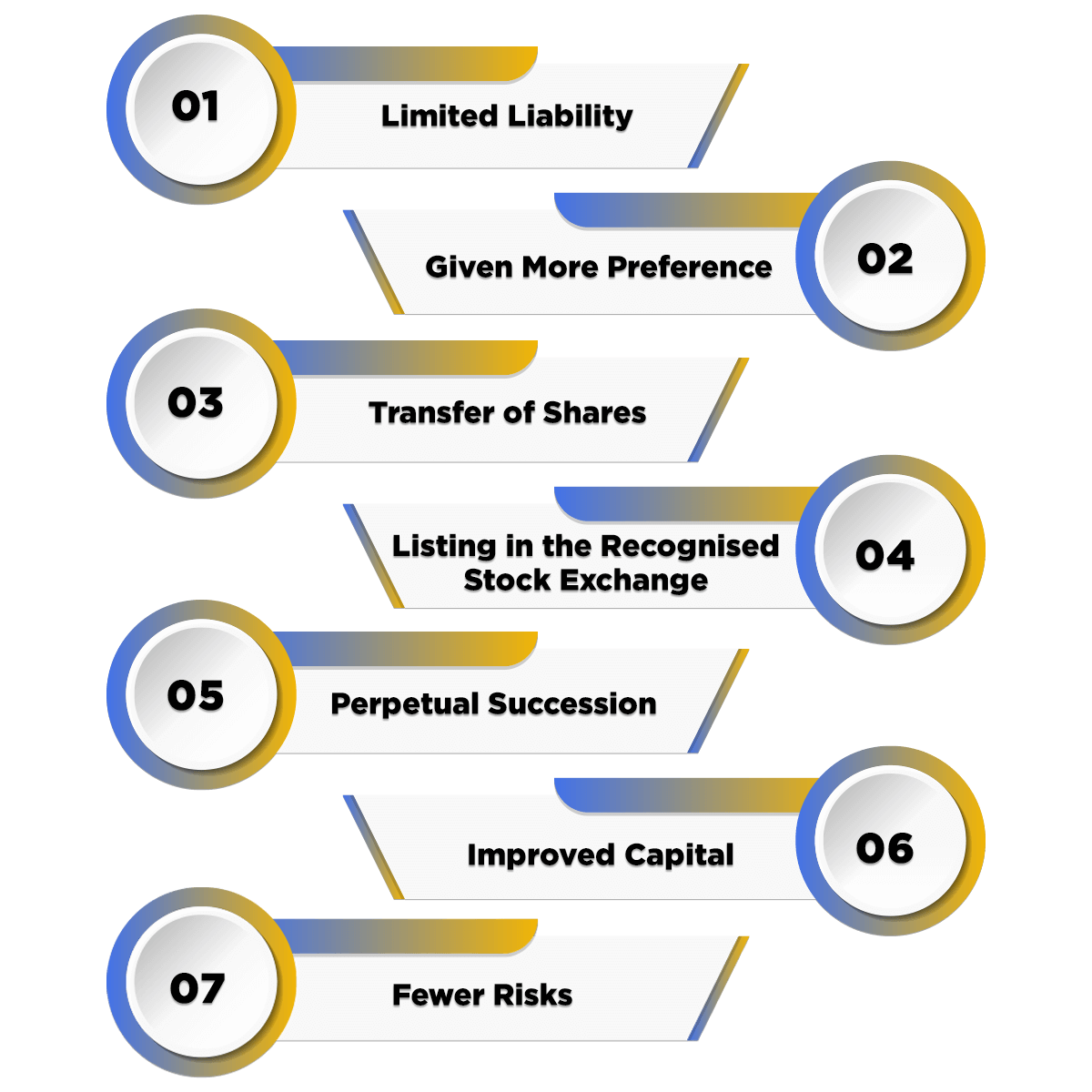

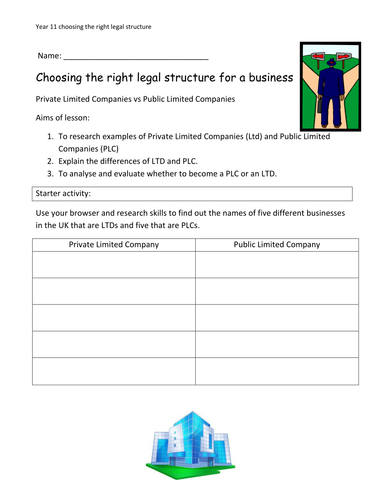

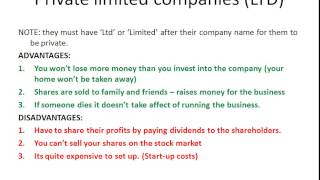

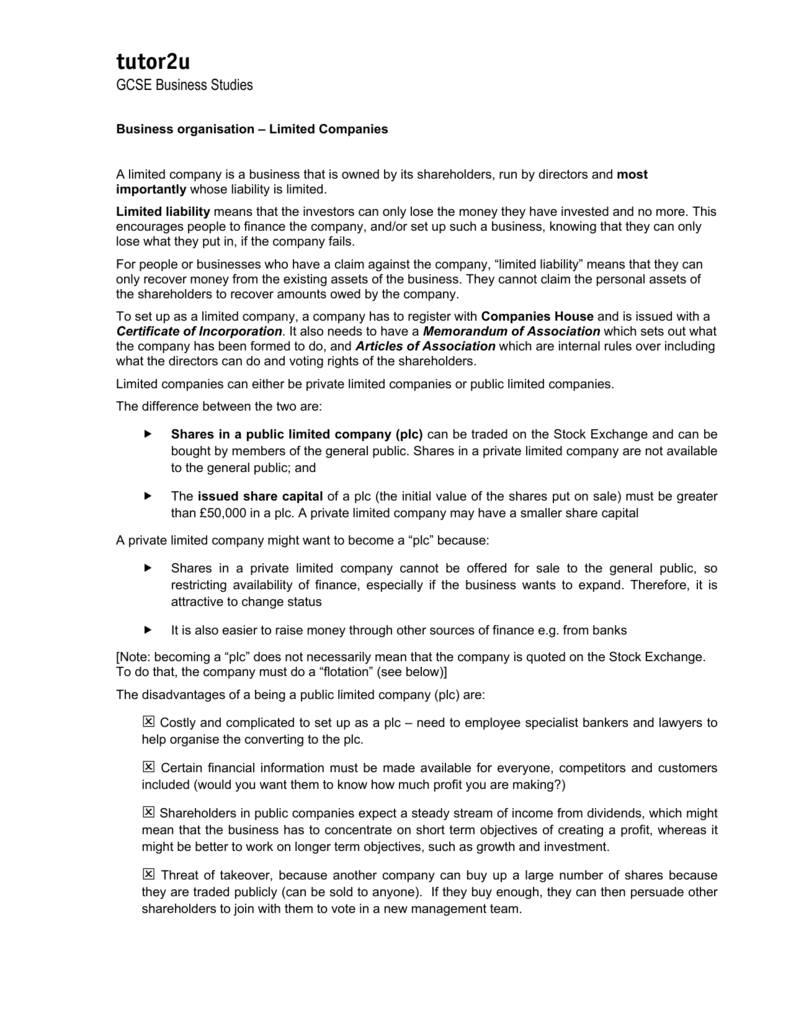

As a limited company, a plc shares the advantages of a limited company with its private counterpart But there are also specific features of a public limited company, many of which reinforce one another, that give it some unique advantages 1 Raising capital through public issue of shares The most obvious advantage of being a public limited company is the ability to Public limited company (PLC) Private limited company (Ltd) A public limited company must have a minimum of £50,000 in share capital No minimum share capital Can sell shares on the stock market to raise money for the company Not permitted to trade on stock market Can only sell or transfer shares privately Requires a qualified secretary and at least twoShares of the public

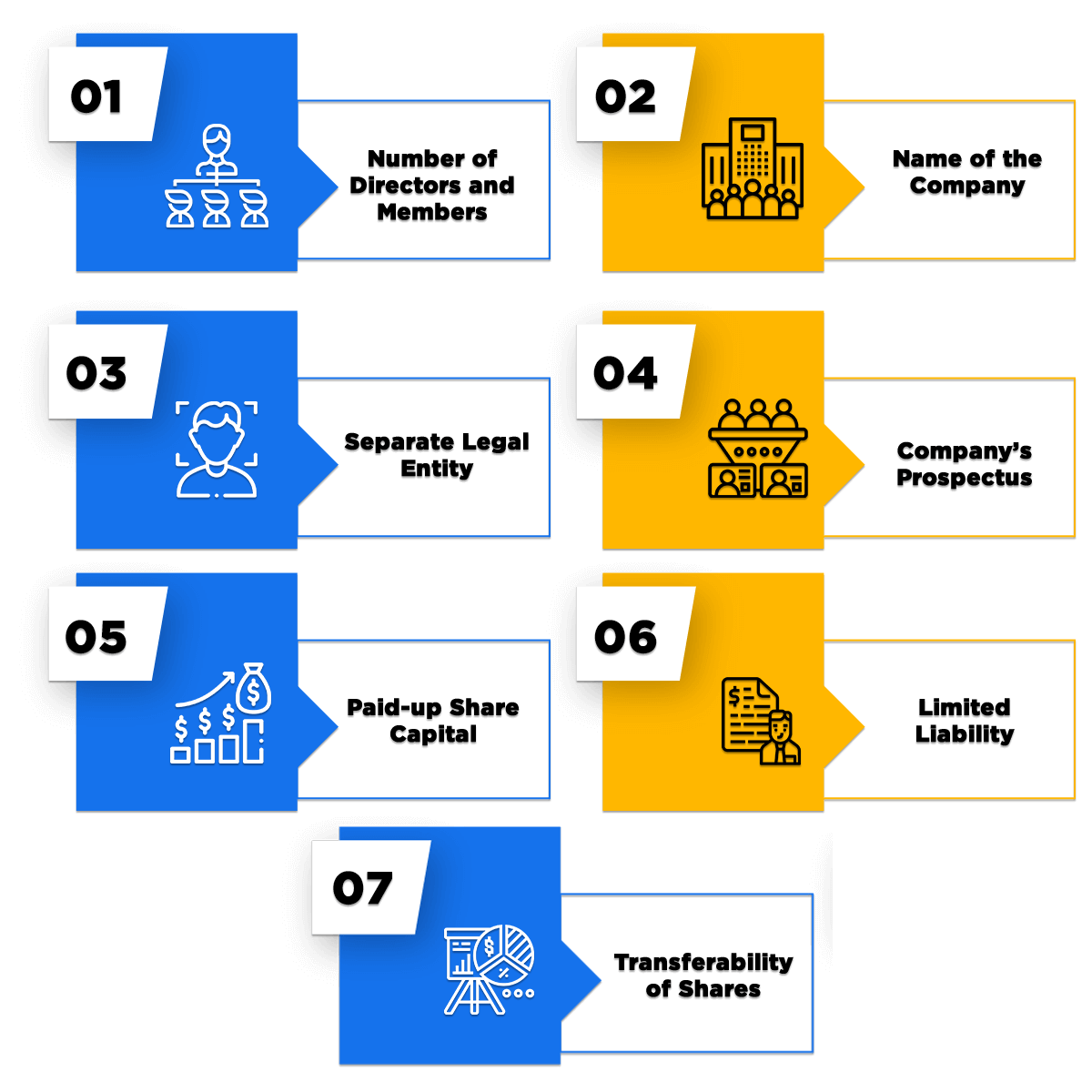

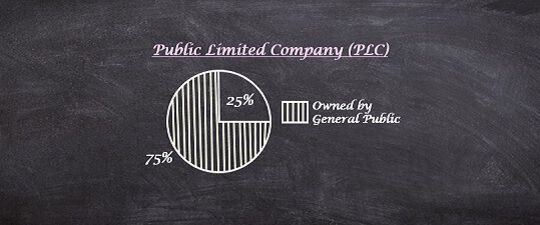

A public limited company must comply with the following It must state that it is a public limited company in its company name The memorandum must contain a clause stating that it is a public limited company and the name must end with PLC It must have an issued share capital of at least £50,000 of which 25% must be paid upDisadvantages of a Public Limited Company A Public Limited Company (PLC) means, first, that the firm is parceled out into shares and sold "publicly" on any or the entire globe's stock exchanges Secondly, it means that those who invest in the firm are protected from extreme loss if the company fails This is called "limited liability" This means that if one invests in a firm thatPublic Limited Company A Public Limited Company (PLC) is set up where the company intends to get itself publicly listed on the Stock Exchange This is done so that the company can offer its shares out to the general public A PLC must have a minimum of seven members, the value of the allotted Share Capital must be not less than €38,090

What Is A Public Limited Company Plc Definition Example Characteristics Incorporation Registration Procedure Advantages Disadvantages The Investors Book

The Benefits Of Becoming A Public Limited Company The Accountancy Partnership

Fill in the order form and pay online We'll register the company for you UK Public Limited Company (PLC) Name A PLC in the UK must choose a company name that is unique from all of the other registered corporations and companies Words like "Holdings", "International" and "Group" are considered sensitive and certain rules must be met to use those words in a company name The abbreviation "PLC" must be included at the end of thePublic limited company refers to the voluntary association of people who come together for carrying out a business together and enjoys limited liability It is simply an artificial person created by law who have distinct identity from its members Public limited company is listed on stock exchange where its shares are traded for offering them to general public Such companies are

Certificate Of Incorporation Of Endo International Plc

Gcse 3 1 10 Public Limited Companies Plcs Youtube

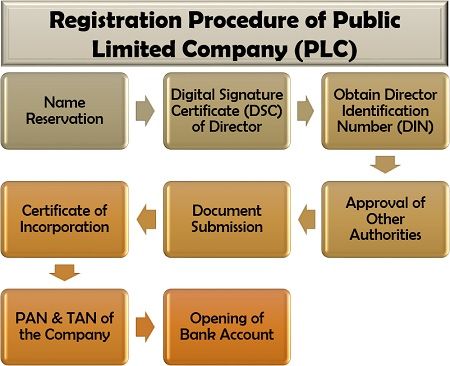

A public limited business operates just as a private limited company (LTD) does in terms of operational capacity; A Public Limited Company (PLC) can be defined as a separate legal entity that carries its business by offering its shares to be traded on the stock exchange; A public limited company is a company whose shares can be freely sold to members of the public There are some specific requirements for starting a PLC Make sure you meet the requirements before you begin What's the process?

Types Of Companies In The Uk Important Documents Of Company Prezentaciya Onlajn

Advantages Of A Public Limited Company Plc Gcse Business Studies Marked By Teachers Com

The initials plc after a UK or Irish company name indicate that it is a public limited company, a type of limited company whose shares may be offered for sale to the publicIn Malaysia, the word berhad or Bhd indicates the same characteristic The designation plc or PLC (either form is acceptable) was introduced in the UK by the Companies Act 1980, and in the Republic of IrelandPublic limited companies (PLCs) are similar to private limited companies, in the sense that they are legally distinct entities with their own assets, profits and liabilities However, shares in a public company can be freely sold and traded to the general public and their shares can be listed on a stock exchange PLCs are the only type of company allowed to raise capital from this type ofThe main characteristic and advantage of a public limited company is that you can raise capital through external investors, in essence, offering shares in your company to the public To set up as a PLC you need to have at least two shareholders and at least £50,000 worth of shares must be issued, although there's no obligation for you to offer any further shares to the public

A Public Limited Company Plc Is Similar In Many Ways To A Private Limited Company To Find Out Public Limited Company Limited Company Private Limited Company

Plc What Is A Public Limited Company Gocardless

Different types of public limited company You can recognise a PLC from its name because, under the Act, it is compulsory to include the 'plc' or 'Public Limited Company' denomination after the public company's name Most of the UK's largest and most wellknown companies are run as PLCsHave issued shares to the public to a value of at least £50,000 or the prescribed equivalent in euros before it Definition A Public Limited Company (PLC) is a separate legal business entity which offers its shares to be traded on the stock exchange for the general public According to the regulations of the corporate law, a PLC has to compulsorily present its financial stats and position publicly to maintain transparency

Whats The Difference Between A Public Limited Company And A Private Limited Company revision Youtube

Types Of Companies In The Uk Important Documents Of Company Prezentaciya Onlajn

A public limited company (PLC) is a business that is legally allowed to sell its shares to the public Similar to a private limited company (LTD), the members of a PLC have limited liability – they are not responsible for the company's debts unless they have given personal guarantees on any business loans Each individual's liability isA public limited company ('PLC') is a company that is able to offer its shares to the public They don't have to offer those shares to the public, but they can Well over 95% of limited companies in the UK are "private" – it is by far the most common form of limited company However, you also need to know about "public" limited companies There are some specific requirements for aLLC stands for "limited liability company," while PLC refers to a "public limited company" Differences Between an LLC and a PLC An LLC is a privately owned business while a PLC is one that is publicly traded on the stock market Each state has its own rules and restrictions regarding LLCs and PLCs, and not every business entity is available in every state An LLC is a common

Higher Business Management Ppt Download

What Is A Public Limited Company And Should You Form One Paramount Company Formations Blogs

When a public limited company sells shares to the public, they're amassing capital as a private limited company Also, if the company is listed on a stock exchange market, it can increase their potentials of being targeted by hedge funds, venture capitalists, mutual funds, and other types of traders and investors Being a PLC also means that the risk of running a businessPublic limited company (PLC) Related Content A company which has shares that can be purchased by the public and which has allotted share capital with a nominal value of at least £50,000 Not all PLCs are listed companies For further information, see Practice note, Public companies Companies Act 06 End of Document Also Found In Company Formation andA public limited company, also known as a PLC, is a company structure available to businesses in the UK Unlike the other structures such as sole trader and partnerships, the business exists as a Unlike the other structures such as sole trader and partnerships, the business exists as a

Public Limited Company In Ireland Setting Up A Plc In Ireland

Public Limited Company Plc Teaching Resources

Une public limited company (dont l'abréviation légale est Plc, parfois portée PLC), traduisible par « société ouverte à responsabilité limitée » ou « société publique à responsabilité limitée », est une forme d'entreprise dans plusieurs pays du monde anglosaxon et du Commonwealth notamment au RoyaumeUni ou également en IrlandeCompany News Markets News Trading News Political News Trends Popular Stocks Apple (AAPL) Tesla (TSLA) Amazon (AMZN) AMD (AMD) Facebook (FB) Netflix (NFLX) Simulator Your Money Personal Finance Wealth Management Budgeting/Saving Banking Credit Cards Home Ownership Retirement Planning Taxes Insurance Reviews & Ratings Best Online Brokers Best Savings A public limited company has most of the characteristics of a private limited company A public limited company has all the advantages of private limited company and the ability to have any number of members, ease in transfer of shareholding and more transparency Identifying marks of a public limited company are name, number of members, shares,

Different Types Of Business Ltd And Plc Part 2 T1

Public Limited Company Advantages And Disadvantages Times Connection

Like a private company limited by shares, a plc is owned by its shareholders (or single shareholder) and run by its directors, each benefiting from limited liability While many of the features are exactly the same as the private equivalent, in this article we look at what makes a public limited company unique and the specific requirements it must meetThe public limited company has than capital which refers to the fund's arrangement by issuing shares in return for cash or other considerations The amount of share capital of a company can change over time because each time a business sells new shares to the public in exchange for cash, the amount of that capital will increase Transferability of shares;A Public Limited Company (abbreviated as PLC) is a public company under British and Irish law It is also a public company in some Commonwealth nations It is similar to publicly traded companies in the US Members of the public can buy and sell a PLC's shares on the stock exchange In order for a company to become a PLC, it has to have a

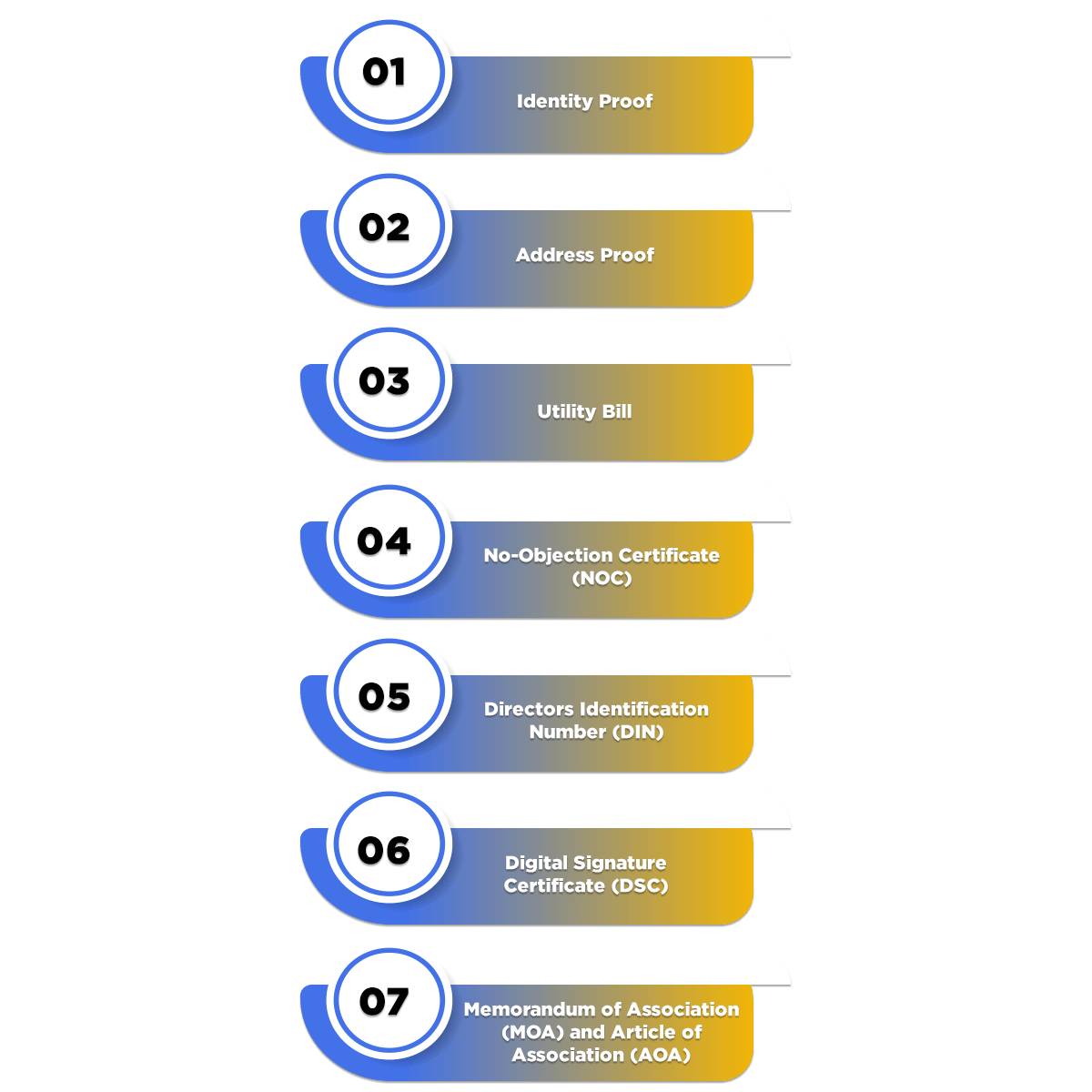

Public Limited Company Registration Benefits Documents Procedure Swarit Advisors

Company Accounts Companies Can Be Divided Into 2 Types A Public Limited Company Which Is Shown As Plc A Private Limited Company Which Is Shown As Ltd Ppt Download

A public limited company, or 'PLC' for short, is a company that is legally allowed to offer its shares for sale to the public They don't have to offer shares to the public if they choose not to, but the option is there if and when needed A PLC is not the most popular choice of company in the UK, in fact over 95% of limited companies in the UK are private limited companies There are certainPublic limited companies (PLCs) exist in their own right This means the company's finances are separate from the personal finances of their members How to setup a public limited company PLCs must have at least two shareholders;The Management Company was formed on 19 February 19 as a public limited company ("société anonyme") under Luxembourg law for an unlimited term allcountryeasyetfcom L a Société d e gestion a été constituée sous la forme d'un e société a nonyme de droit luxembourgeois le 19 février 19 pour une durée illimitée

Convert Ltd To Plc

How To Form A Public Limited Company 15 Steps With Pictures

However, it is also separate in how it works, as shares are open to public ownership Anyone can buy and sell stocks in the corporation, should they be available Because of this public access, the business must publish its annual statutory account results toIf the term 'public limited company' or 'PLC' as it's better known conjures up visions of a giant corporation on the scale of a BP or Siemens, that's not the case The requirements for becoming a public limited company are much simpler You must have Minimum of two directors and shareholders Minimum of £50,000 share capital A qualified company secretary Advantages of1 a) A public limited company (PLC) is often a large company and has the legal right to sell shares of the company to the general public on the stock exchange platforms Shareholders have limited liability as they own only a percentage of the company, therefore in case of failure, they b) The share price is the value a company's single stock has at a certain moment in time, in other

Public Limited Company Definition Features Advantages Disadvantages

What Is A Public Limited Company Plc Definition And Meaning Market Business News

Apple is a Public Limited Company, found by Steve Jobs and Steve Wozniak in 1976, which design, develop and sell their goods worldwide and operate in telecom and technology industry Their headquarters are located in Cupertino, California, USA Apple, being a successful technology and telecom company in the secondary sector who have lots of capital, have chosen to be a Advantages of public limited company Capital The main advantage of a public limited company is that large amounts of capital can be raised quickly Bulk buying A public limited company is highly benefited from bulk buying They can invest in different fields and at the same time share the profit with the shareholders Converting a Private Limited Company to a Public Limited Company LtdPLC A UK Private Limited Company may wish to reregister as a Public Limited Company to be able to offer its shares to the public The 06 Companies Act allows a Private Limited Company to be reregistered as a Public Limited Company if it meets specified conditions Companies House will

Private And Public Limited Companies Ppt Video Online Download

What Is The Difference Between A Private And Public Limited Company The Accountancy Partnership

PLC stands for Public Limited Company A PLC designates a company that has offered shares of stock to the general public, moreover, the buyers of those shares have limited liability which means they cannot be held responsible for any business losses in excess of the amount they paid for the shares In the UK, company law says that a Public Limited Company

Private Limited Company Ltd Public Limited Company Plc Limited Liability Ppt Worksheets Teaching Resources

Limited Company And Plc Teaching Resources

Types Of Organisations Understanding Business Higher Business Management

February 13 Igcse And As Level Business Studies

Public Limited Company Registration Benefits Documents Procedure Swarit Advisors

Ppt Limited Companies Powerpoint Presentation Free Download Id

Public Limited Company Definition And Guide

What Is A Public Limited Company Plc

Plc Definition Public Limited Company Abbreviation Finder

Gcse 3 1 10 Public Limited Companies Plcs Youtube

Public Limited Company Registration Updates In Corpstore

What Are The Different Types Of Limited Companies In The Uk Company Bug

Cost Of Forming An Unlisted Public Limited Company Plc Inform Direct Support

What Is A Public Limited Company Nerdwallet Uk

Advantages Of A Public Limited Company Plc Gcse Business Studies Marked By Teachers Com

Choosing The Right Legal Structure Private Ltd And Public Plc Year 11 12 Teaching Resources

Higher Business Management Ppt Download

Harvey Group Plc Next Plc Logo Public Limited Company Png 2218x640px Harvey Group Plc Black And

What Is A Public Limited Company Plc Definition Example Characteristics Incorporation Registration Procedure Advantages Disadvantages The Investors Book

What Is A Public Limited Company Plc Definition And Meaning Market Business News

Types Of Companies In United Kingdom Types Of Uk Companies

Guide Pros Cons Of A Plc Blue Sky Company Formations

Public Limited Companies Plc S

What Are Some Examples Of Public Limited Companies Plcs Quora

Whats The Difference Between A Public Limited Company And A Private Limited Company revision Youtube

Limited Companies Year 10 Business Studies Learning Objectives

Convert Pvt To Plc Advantages For Public Limited Company

Public Limited Company Teaching With Crump

1 Business Management Unit What Do Businesses Do Ppt Download

Ocr Gcse Business New Spec 1 3 Business Ownership

Types Of Business Ownership Gcse Business Studies Mixed

Types Of Organisations Understanding Business Higher Business Management

Advantages And Disadvantages Of A Public Limited Company

Private Limited Company Ltd And Public Limited Company Pl By Yuka Ashida

Chapter 7 Corporations And Legal Personality

What Is A Public Limited Company Plc Datagardener

Private Limited Company And Public Limited Company Gcse Business Studies Marked By Teachers Com

Public Limited Company Definition Full Explain

What Is A Public Limited Company Plc Definition Example Characteristics Incorporation Registration Procedure Advantages Disadvantages The Investors Book

What Are Public Limited Company Jobs Ecityworks

What Is A Public Limited Company Plc Definition Example Characteristics Incorporation Registration Procedure Advantages Disadvantages The Investors Book

Plc Public Limited Company Royalty Free Vector Image

Public Limited Company Plc Formation Blue Sky Formations

1

Private And Public Limited Companies Hw Sheet Doc

Public Limited Companies Gcse Business A Level Business Youtube

Advantages Or Benefits Of Public Limited Company Plc Registration

Public Limited Company Aka Plc By Omar Abed

1

What Is A Public Limited Company Plc Definition Example Characteristics Incorporation Registration Procedure Advantages Disadvantages The Investors Book

Public Limited Company Advantages And Disadvantages Rs Blogs

A Level Business Revision Public Limited Companies Plc S Youtube

Price Of Tutor2u

Public Limited Company Wikipedia

Types Of Business Ownership Christopher S Revision

What Is A Public Limited Company Plc Definition And Meaning Market Business News

Public Limited Company Definition Features Advantages Disadvantages

Public Limited Company Plc Formation Requirements Advantages Uk Dns Accountants

Private Limited Company Ltd Public Limited Company Plc Limited Liability Ppt Worksheets Teaching Resources

/Harry_Gibbs_Commonwealth_Law_Courts_Building_Brisbane_01-8efbce72009d4ef2910654712e9d4912.jpg)

Ltd Limited Definition

Acronym Plc Public Limited Company Stock Illustration

How To Form A Public Limited Company 15 Steps With Pictures

Difference Between Private And Public Company Under Companies Act 13

Plc Mig Cambodia

1

Calameo Public Limited Company Uk Faqs Frequently Asked Questions

Public Limited Companies Youtube

Public Limited Company Registration Benefits Documents Procedure Swarit Advisors

How To Form A Public Limited Company 15 Steps With Pictures

Private And Public Limited Companies Ppt Video Online Download

1

Credible Corporate Services Public Limited Registration Company

Public And Private Limited Companies Plc S And Ltd S Ppt Download

Types Of Business Ownership Gcse Business Studies Mixed

Public Limited Company Examples Galeriјa Slika

Business And Management Topic 1 Business Organization And

Plc Public Limited Company By Acronymsandslang Com

Pyramid Ict Training Center Characteristics Of Public Limited Company Facebook

How To Form A Public Limited Company 15 Steps With Pictures

The Advantages And Disadvantages Of A Public Limited Company Mazuma

0 件のコメント:

コメントを投稿